Malaysia Income Tax Calculator Lhdn

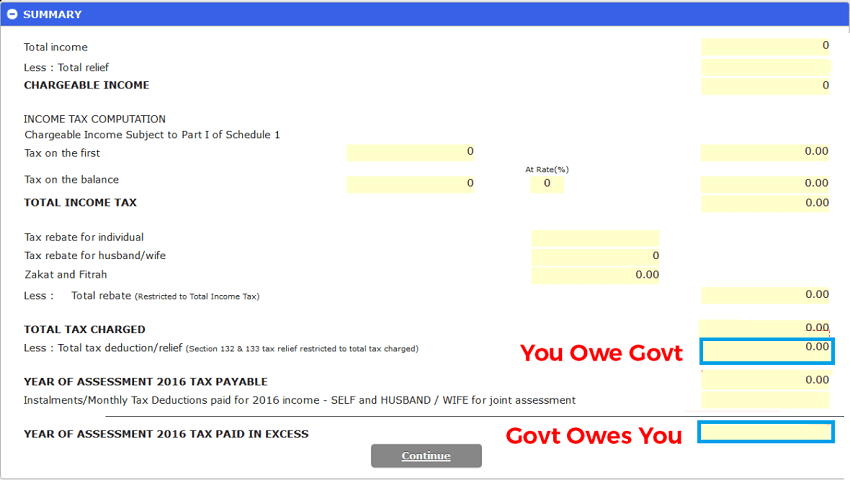

On the first 2 500.

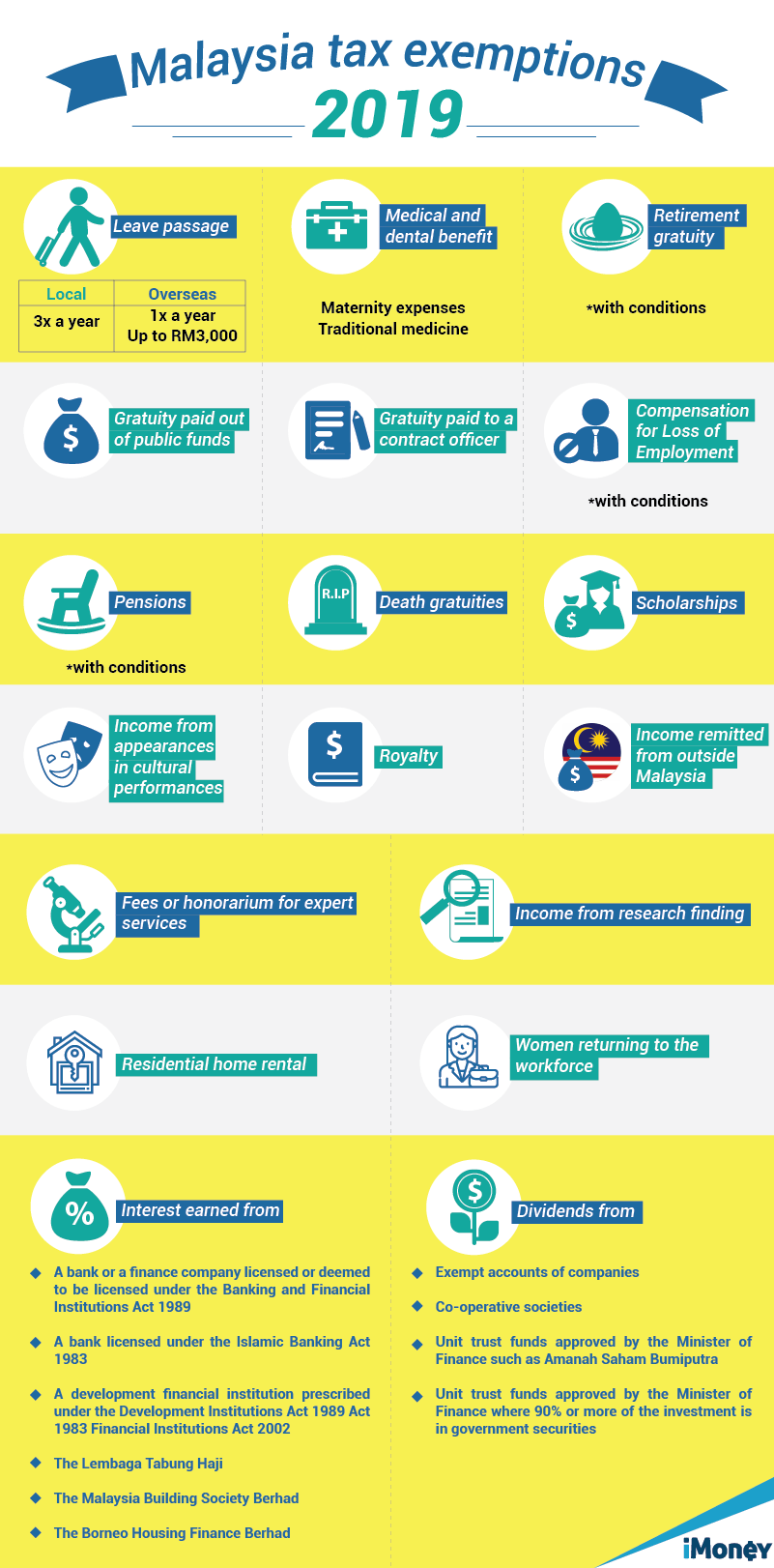

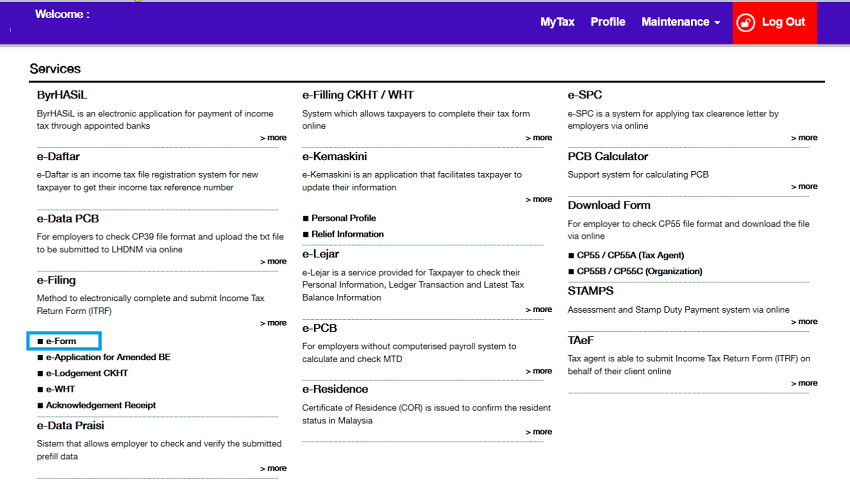

Malaysia income tax calculator lhdn. On the first 5 000 next 15 000. To check and sign duly completed income tax return form. This relief is applicable for year assessment 2013 and 2015 only.

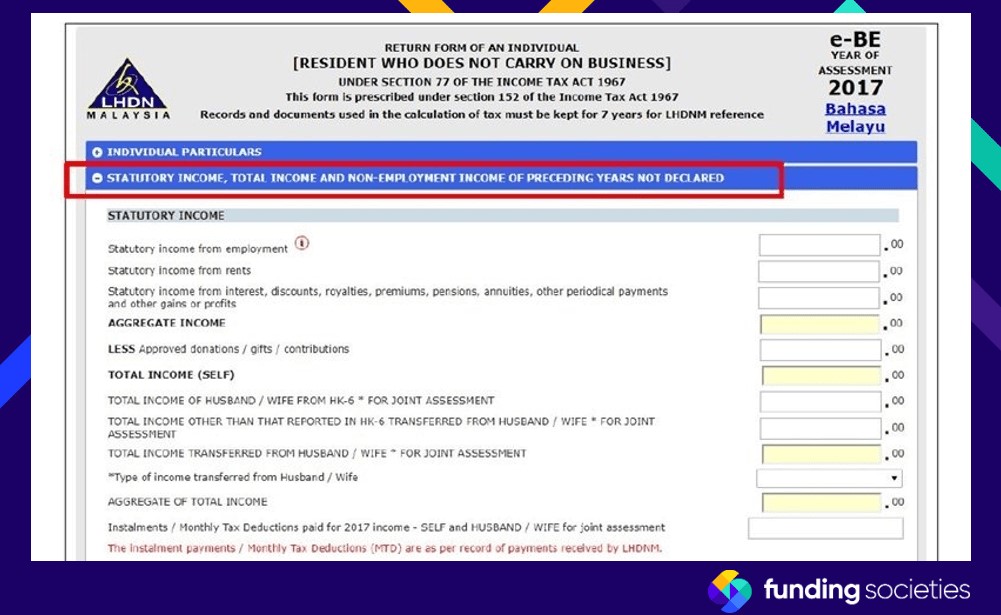

As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs. Hak cipta terpelihara unit e apps bahagian aplikasi e services lembaga hasil dalam negeri. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes.

Pcb tp3 form 2020. All supporting documents like business records cp30 and receipts need not be submitted with form p. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor.

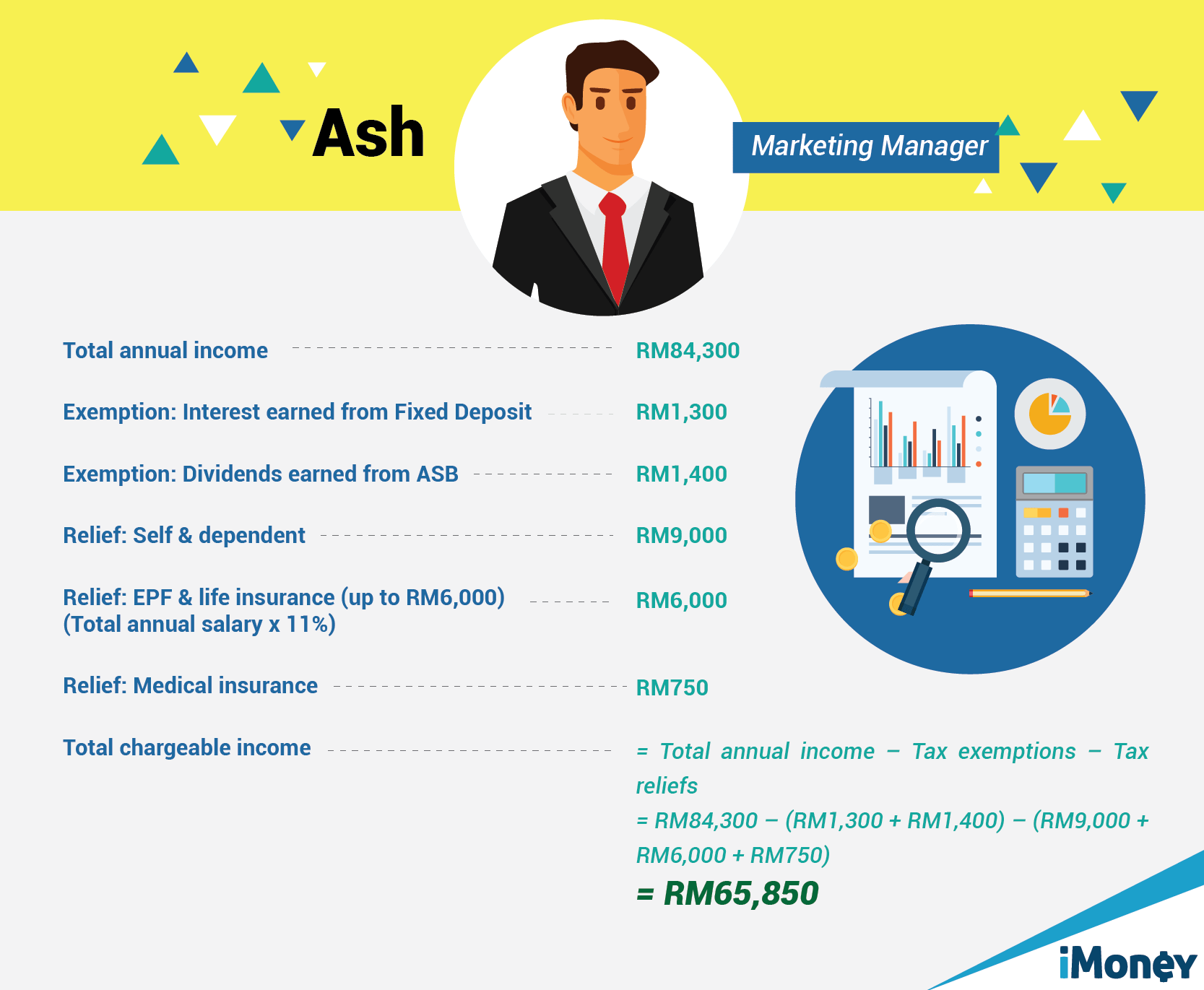

Calculations rm rate tax rm 0 5 000. Special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. To submit the income tax return form by the due date.

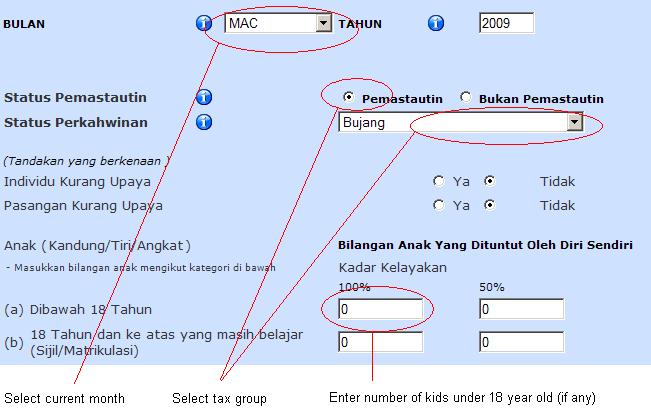

Kkcp pind 2019. Previously not employed in current year. Bahasa malaysia kkcp pind 2015 guidelines.

For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. 204 tarikh kemaskini. Paling sesuai menggunakan ie.

Pcb stands for potongan cukai berjadual in malaysia national language. Husband and wife have to fill separate income tax return forms. Previously employed in current year.

Pcb tp1 form 2020. To compute their tax payable. Simple pcb calculator is a monthly tax deduction calculator to calculate income tax required by lhdn malaysia.